Table of Contents

Introduction

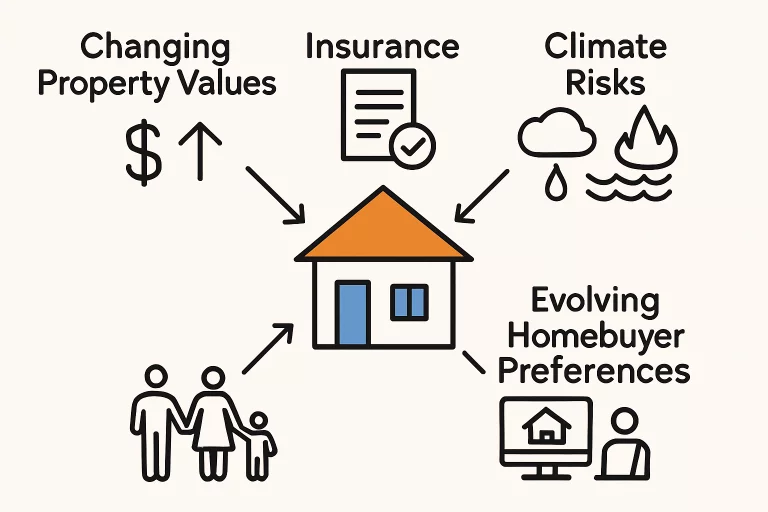

Understanding real estate market dynamics has become crucial for homeowners who wish to secure their financial future and make informed property decisions. The real estate landscape is subject to constant change, influenced by economic conditions, demographic shifts, and global phenomena such as climate change. Beyond property values, fluctuating insurance costs and evolving homebuyer preferences are shaping the experiences of current owners and those considering entering or exiting the market. Whether you’re planning to relocate or weighing your property as a long-term investment, keeping an eye on market trends and adjusting your strategies accordingly is essential. For homeowners seeking quick solutions—particularly in uncertain times—collaborating with professionals who buy houses any condition offers a way to sell rapidly and with less hassle, regardless of market volatility.

From dramatic surges in insurance premiums caused by increasing climate risks to the impact of shifting buyer behaviors and the looming effects of environmental changes, the real estate market is evolving at an accelerated pace. Staying ahead of these trends helps homeowners make wise financial choices and enables them to protect and possibly enhance the value of their most important asset. Navigating these complex dynamics requires vigilance, adaptability, and a willingness to invest in knowledge and property enhancements that safeguard investments for the long term.

Impact on Property Values

Property values form the backbone of household wealth for many Americans, yet they are closely linked to the overall economy and specific market trends. Home values generally rise during periods of economic expansion, such as when new businesses move in, infrastructure improves, or job opportunities increase. These conditions often boost equity, enhance refinancing options, and raise the potential for profit if owners choose to sell. An easy sale can be a smart way to capitalize on favorable market conditions. On the other hand, economic downturns, factory closures, or natural disasters can cause property values to plummet. When that happens, homeowners may face limited refinancing opportunities, postpone necessary repairs, or feel pressure to relocate, especially if their equity shrinks or costs begin to outweigh benefits.

Interestingly, home value fluctuations are rarely uniform across a city or region. Variables such as proximity to top-rated school districts, lifestyle-oriented amenities, overall crime rates, and nearness to employment hubs can carve out “micro-markets” within a larger area. These hyper-local factors mean two neighborhoods just a few blocks apart might experience vastly different price trends, even in the same economic environment. For homeowners looking to capitalize on timing or who need to sell in any condition or market, turning to companies that buy houses can provide immediate liquidity and simplify transactions, helping people adjust to new realities without unnecessary delays or investment in repairs.

Rising Insurance Costs

One of the most significant—and least predictable—shifts in the real estate market today centers around the surging cost of home insurance. The frequency and intensity of natural disasters like hurricanes, wildfires, and inland flooding are not just making headlines but also forcing insurers to reconsider risk profiling and rate structures dramatically. The impact is staggering: a recent First Street report warned that the compounded impacts of climate change could eliminate nearly $1.47 trillion in net property value, a blow brought on by rising premiums and changing market demand. Some insurers have even begun withdrawing coverage in especially vulnerable locales, leaving homeowners scrambling for protection or facing exorbitant premium hikes.

For most homeowners, budgeting now means more than covering a mortgage and the occasional repair—it entails planning for growing annual insurance costs, which can rise unpredictably from year to year. To keep these expenses in check, consider comparing quotes from multiple providers, proactively mitigating home-specific risks (such as upgrading roofs or installing flood barriers), and reviewing your property’s placement on local hazard maps. Ultimately, a vigilant approach to insurance can make the difference between affordable homeownership and being priced out by risk-related increases.

Shifts in Buyer Behavior

The past few years have seen radical shifts in how home buyers interact with the housing market. Sky-high purchase prices fueled by limited inventory and repeated mortgage rate hikes have intensified buyer scrutiny and driven new demand patterns. Recent surveys, such as one conducted by Bank of America, show that Americans—whether first-time buyers or seasoned homeowners—are expressing greater uncertainty than ever about whether, when, and even where to buy or sell property. Key drivers include rising borrowing costs, sticker shock from home prices, and doubts about economic stability. As the pool of buyers adjusts, only homes that closely match emerging buyer criteria will remain in high demand.

What This Means for Sellers

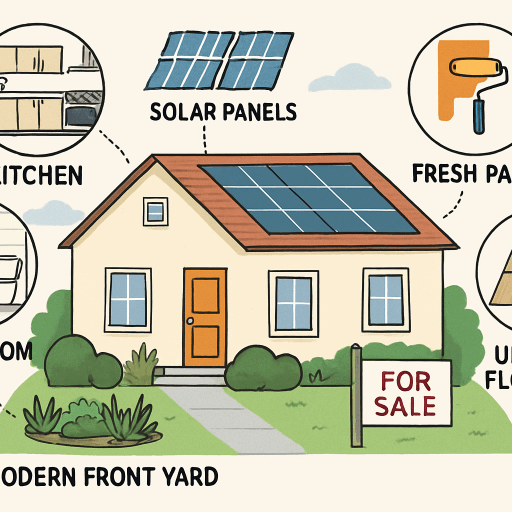

For current homeowners looking to sell their homes, understanding and responding to these behavioral trends can give them a significant edge. Today’s buyers are typically looking for homes that promise comfort and long-term resilience—think energy efficiency, dedicated remote work spaces, strong broadband connectivity, and locations with proven climate resilience. Homes in areas feeling the brunt of mortgage rate hikes or those requiring substantial repairs may experience extended time on the market or necessitate price cuts. Sellers may benefit from flexible, streamlined options, such as selling to direct cash buyers or “as-is” purchasers, which can facilitate quick moves and avoid the unpredictability of traditional listings, even in challenging or slow-moving markets.

Climate Change and Real Estate

The growing influence of climate change on real estate is undeniable, and its impact is reshaping homeowner priorities nationally. What was once considered premium real estate—coastal or riverside properties with picturesque views—may now carry increased costs and risks due to flood potential, erosion, and insurance challenges. Insurance companies have raised premiums or abandoned the market in the West and other fire-prone areas, prompting buyers and existing owners to reconsider long-held assumptions about desirable locations. Simultaneously, many inland or higher-elevation markets that were once overlooked are now attracting buyers who seek long-term safety and affordability.

To adapt, proactive homeowners are adopting innovative strategies that help their properties withstand environmental threats and maintain value over time. These approaches include elevating utilities in flood zones, installing impact-resistant materials, and embracing drought-tolerant landscaping that requires less water. Buyers also incorporate advanced climate risk assessments into their decision-making, reviewing historical storm data, floodplain maps, wildfire risk, and long-term environmental forecasts. For those living in or considering at-risk areas, staying up to speed on evolving legislation, local building codes, and changing insurance requirements is essential to safeguarding their investment and personal safety.

Strategies for Homeowners

Successfully navigating today’s shifting real estate landscape requires preparation, adaptability, and a willingness to embrace emerging best practices. Here are some essential steps every homeowner should consider:

- Stay informed: Regular monitoring of market data, nearby sales, regional trends, and local economic indicators can yield insights into where values may be heading and highlight opportunities or red flags. Use reputable resources such as local realty reports and the First Street Foundation for climate risk data.

- Assess and mitigate climate risk: Get your property evaluated for exposure to natural hazards—such as fire, flood, and storm surge—and take steps to safeguard what matters most.

- Invest in upgrades that boost resilience and reduce insurance costs: Installing solar panels, high-strength windows, elevated utility systems, and efficient heating/cooling systems can make your home more desirable, more affordable to insure, and better protected against extreme weather.

- Consult with local professionals: Leverage the expertise of real estate agents, insurance brokers, and contractors who know your neighborhood, understand local trends, and can advise you about smart investments and compliance with evolving regulations.

- Explore flexible selling options: For those needing to sell on a tight timeline or without extensive updates, exploring direct sales—especially with buyers who purchase homes as-is—provides an efficient, stress-free alternative to the traditional path. Consider working with companies online to access quick, market-independent sales solutions.

Ultimately, homeowners who take a strategic, thoughtful approach—by staying educated about market and climate risks, investing in the right improvements, and considering all available selling avenues—put themselves in the best possible position to protect and potentially grow their equity in any market cycle. In an unpredictable landscape, the key is to plan for the unexpected and act proactively to ensure long-term safety and security for yourself and your investment.