Selecting a popunder network should not feel like throwing darts in the dark and hoping something sticks. But too many advertisers take that approach, registering at the first option they see in a Google search or going with whatever the colleague down the hall casually suggested. But in reality, these networks are not all created the same; they all possess different qualities and different traffic sources leading to the results they’ve generated in the past.

What works exceptionally for one advertiser and one campaign type could flop miserably for another and yet, without digging deeper past the generic attributes, advertisers have no real way of understanding this.

It’s true that most advertising platforms boast similar appeal when it comes to claiming traffic quality and targeting potential. Everyone’s got “premium inventory” and “advanced optimization”. Everyone boasts conversion rates through the roof with transparency in reporting. Yet when campaigns run and budgets dissipate, those high volume selling points mean very little. What’s more important are the individual attributes that make certain networks worthy of battle-tested campaigns and others, disposable fluff.

Table of Contents

- 1 Traffic Quality Makes or Breaks Campaign Performance

- 2 Geographic and Demographic Targeting Depth

- 3 Pricing Models and Minimum Commitments

- 4 Reporting Transparency and Data Access

- 5 Publisher Relationships and Inventory Access

- 6 Support Quality When Things Go Wrong

- 7 Testing Windows and Optimization Flexibility

- 8 Making The Decision

Traffic Quality Makes or Breaks Campaign Performance

Herein lies the thing about popunder advertising: it’s relatively basic as a format. A new window opens up behind the active windows, the user sees it eventually, and action occurs, hopefully. Yet where that impression comes from and what’s behind the quality varies dramatically. Thus, two networks charging essentially the same CPM could yield completely different results. This is where traffic quality comes into play.

Traffic quality involves more than whether or not a certain amount of humans generated clicks. Traffic quality relates to where traffic originates from, what traffic does at the time of exposure to the ads and then what state of mind they’re in to attempt some type of engagement. Some networks generate traffic from iffy means, toolbar installations, sketchy download buttons or incent traffic where people paid per click until certain placements kick in. Other networks maintain stricter guidelines about publisher quality and traffic access.

Unfortunately, few networks will openly provide their traffic sources as part of marketing collateral beyond vague statements about “global reach” or “diverse partnerships with publishers”. This is where a savvy advertiser steps in and asks questions. What’s the split percentage between owned and operated traffic versus third-party? How do you vet your newer publishers? What’s your policy on incent traffic/toolbar-generated impressions? If a network can’t give a definitive answer, they may be hiding information you’d rather know about.

Geographic and Demographic Targeting Depth

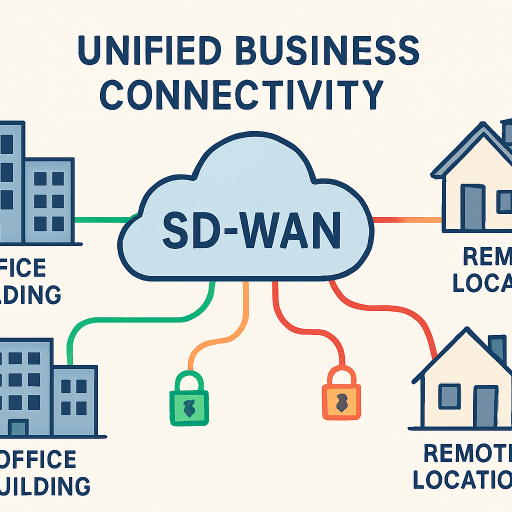

Many popunder networks position themselves as a mass-reach solution, and many advertisers use them this way – for campaigns that demand high-volume exposure without extensive targeting needs. But this doesn’t mean targeting doesn’t exist. The difference between basic country-level targeting capabilities versus city-level geographical insights, device-level filtering and behavioral targeting can mean a lot for campaign performance.

Targeting matters more than many will realize when it shouldn’t, it’s never enough to say “I want my campaign to target the US”. The difference between someone in New York City as opposed to someone in rural Montana is oftentimes enough for most offers. And for those who work with companies that boast the best popunder network options find themselves with access to greater controls that allow them to get more granular than just country code benefits. This is especially critical when testing markets for scaling profitably.

The same goes for device type. Mobile traffic operates on a different behavioral level than desktop, and being able to segregate between each (or move down the line to operating systems, browsers and even connection types) gives advertisers an advanced sense of control over how their campaigns perform. Some networks treat all traffic as equal; other recognize that mobile users on 4G are not necessarily the same users sitting on desktops with Fiber internet.

Pricing Models and Minimum Commitments

Most popunder networks work on a CPM basis, you pay per M regardless of what happens after that point. This means that predictability is frequent but all performance-related risk is on the advertiser. A select few networks will use CPA or revenue share models although there are fewer options using popunder inventory specifically. It’s not only what’s cheap but how cheap it gets when volume increases matters when determining sustainable growth.

Minimum deposits and spending amounts drastically differ from network to network; some platforms allow for testing at $100 or $200 while others require a $1k investment just to get in the door. Neither option is better than another; instead they signal different things about who each network appeals to better, higher minimums suggest a network catering to larger advertisers with built-in testing budgets while lower minimums suggest a network more friendly to smaller ventures or those still getting their feet wet with this format.

Also pay attention to how pricing shifts with increased volumes. Some networks reduce costs; others keep them flat across the board. If there’s no opportunity to save on bulk purchases but you’re set on scaling like crazy, be prepared for the long-term economics of your decision.

Reporting Transparency and Data Access

Guessing how well your campaign performed without good data is an expensive game of chance. What networks can offer reporting insights will help after-the-fact of campaign development because this directly impacts how performance holds up and whether scaling/termination is possible in due time. Basic metrics (impressions, clicks, conversions) are what strong networks boast will help; what separates good from bad is access to deeper levels of data that come quickly.

Real-time reporting should never be an additional expense; it should be expected, especially with popunders where traffic frequently changes moment-to-moment within days worth of impressions at a minimum spend. Networks that only report once or twice daily make it easy to rack up significant budgets before advertisers spot an issue. The ability to segment impressions by geography, device, time and day and publisher helps find what’s working and what’s not quickly.

Conversion data integration is another major piece, does the network make pixel install easy? Is postback tracking available? Can you pass custom parameters in place for certain offers/source? How well does network conversion tracking manage conversions (sales versus leads versus installs)? Networks with poorly functioning attributions waste advertisers time and money trying to figure it out along the way.

Publisher Relationships and Inventory Access

Ultimately, it’s the publishers who provide ad inventory, and thus buying traffic from those publishers with solid relationships can mean inventory that’s unavailable elsewhere. If a network only aggregates access through broker networks, they’re selling commoditized traffic available anywhere for likely cheaper.

Exclusive inventory isn’t good or bad but a differentiating factor; if multiple networks have access to publisher inventory, then you’re ultimately competing with other advertisers on both those platforms for similar impressions since they’re all showing everywhere else as well. Exclusive partnerships get you access to buyers who aren’t inundated with other competitive messaging.

Indirectly, publisher payout structures make a difference, those networks who pay their publishers quickly and nicely tend to have better relations long-term; those networks known for delayed payout disputes tend to lose momentum with publisher traffic who takes their business elsewhere.

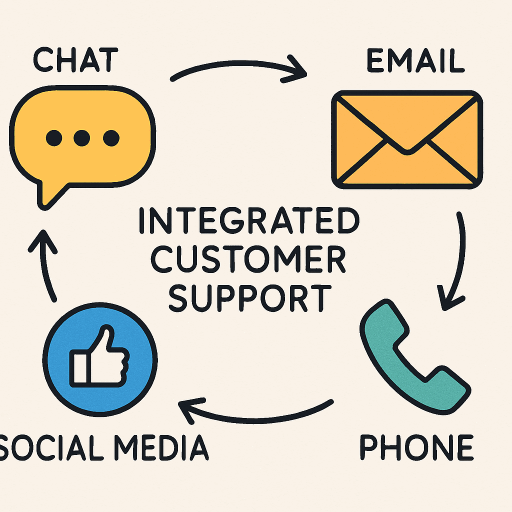

Support Quality When Things Go Wrong

Every network has great support when you’re depositing money into your account with them. The true measure of support comes when something goes wrong, tracking goes awry, content performance starts dropping overnight for reasons unbeknownst to anyone else on board, even after previously performing well. How these networks respond determine if they’re your partner or just brokers collecting commissions.

Speed matters as campaigns are often time sensitive; any network that takes 24-48 hours responding creates compounding situations where issues can’t get fixed before money is lost. High-quality support comes in account manager form (not just ticket systems or generic support).

The willingness for networks to investigate as far as quality of sources raised their awareness regarding changes. Strong networks will look into specific campaigns, assess where impressions are coming from, block/pause certain publishers if they’re not meeting thresholds on their end; weak networks rarely do anything except blame problems on either third-parties or buyers themselves.

Testing Windows and Optimization Flexibility

No network performs equally for every advertiser/offer type; what performs exceptionally well for lead generation might bomb miserably for e-commerce; what converts like crazy in one geography might fall flat in another which means testing is not optional, but mandatory, and how friendly a network is toward testing determines your ability to find profitable campaigns.

Certain networks will promote testing everywhere allowing small budgets split among targeting options; others will promote larger budgets forcing loyalty at smaller levels not cost effectively viable, but instead put together down the road after performance assessment renders consistency. The ability to test small then scale gradually reduces risks but provides legitimate performance data.

How campaigns can be optimized, automated adjustments, algorithms look for additional opportunities based on what segments, differently across networks. Some allow all; some require manual management for everything but that’s not necessarily wrong; it’s just how each option works better for either party operating differently than expected.

Making The Decision

In reality, selecting a popunder network ultimately comes down to understanding what works best for your needs versus theirs, high volume direct response advertisers need something different than awareness campaigns; established campaigners looking for tracking need something different than those just getting started with these efforts.

The biggest mistake any advertiser can make is doing so based on surface-level options, pricing, signup bonuses or how professional their site looks. Yes, these matter but not when determining what makes campaigns successful (or flounder).

Traffic quality, targeting potential, reporting depth and support response will impact whether campaigns truly work out or fail miserably, all factors one should take their time evaluating upon anticipated setup through asking detailed questions in sales calls before starting small tests out instead of full budgets initially until proven right. Avoid these expensive mistakes by knowing what you’re looking for beforehand.