Table of Contents

- 1 Table of Contents

- 2

- 3 Introduction to Asset Protection

- 4 Understanding the Role of Business Structures

- 5 Essential Components of LLCs, Partnerships, and Corporations

- 6 Real-Life Scenarios of Asset Protection

- 7 Legal Considerations in Asset Protection

- 8 Common Mistakes to Avoid in Asset Protection

- 9 Future Trends and Innovations in Asset Protection

Table of Contents

- Introduction to Asset Protection

- Understanding the Role of Business Structures

- Essential Components of LLCs, Partnerships, and Corporations

- Real-Life Scenarios of Asset Protection

- Legal Considerations in Asset Protection

- Common Mistakes to Avoid in Asset Protection

- Future Trends and Innovations in Asset Protection

- Conclusion

Introduction to Asset Protection

Asset protection has become a cornerstone of modern business management, acting as a critical shield against potential adversities that may threaten a business’s financial health. The principle of asset protection is to devise strategies that prevent or severely limit the exposure of one’s assets to risk, especially in situations like litigation or economic downturns. Implementing effective asset protection strategies, such as understanding how to protect your LLC, is essential to a business’s risk management toolkit. These strategies preserve assets and enable businesses to operate from a position of financial security, which is indispensable in today’s volatile market conditions.

Understanding the Role of Business Structures

The effectiveness of asset protection is intricately linked to the choice of business structure, as it dictates the legal and financial dynamics between the business and its owners. Opting for the proper business structure is not a one-size-fits-all decision but should be determined by a business’s specific needs and aspirations. For instance, Limited Liability Companies (LLCs) are favored by many entrepreneurs due to their ability to limit owners’ liability while providing flexibility in management structures and tax benefits. This characteristic is desirable to sole proprietors and small business owners who seek to balance simplicity with protection. In contrast, corporations offer more rigid structures but deliver enhanced protection and opportunities for growth through stock issuance, making them ideal for scaling businesses looking to attract investors. This decision is pivotal. It must be made with an acute awareness of economic trends, ensuring that the structure aligns with the broader market dynamics and the enterprise’s strategic goals.

Essential Components of LLCs, Partnerships, and Corporations

A detailed understanding of the distinct features of LLCs, partnerships, and corporations is imperative to determine which structure best suits a business’s needs. LLCs combine liability protection and operational flexibility, making them an appealing choice for various business types. They allow owners to protect their assets from claims against the business, effectively creating a buffer zone between professional and personal finances. Partnerships, involving multiple individuals, allow for shared responsibility and resources, though they can pose risks of personal liability unless structured as limited liability partnerships (LLPs). Corporations stand at the other end of the spectrum, offering a separate legal entity capable of ownership transfer through stock sales, thus affording a high degree of separation between owners and managers. Each of these structures requires thorough consideration of the business’s objectives, the intended scale of operations, and potential future growth, as these factors will significantly influence the efficacy of asset protection measures.

Real-Life Scenarios of Asset Protection

Examining real-world scenarios provides valuable insights into how businesses have successfully or unsuccessfully managed their asset protection strategies. Consider a technology startup initially structured as an LLC, which safeguarded its founders’ assets from corporate liabilities once the venture faced unexpected operational challenges. This foresight allowed them to weather economic storms while preserving personal financial health, demonstrating the usefulness of choosing a structured approach from the outset. Conversely, numerous businesses face liquidation due to a lack of protective measures, proving these strategies’ importance. Businesses without sufficient asset protection often find themselves vulnerable to creditors and legal actions, leading to financial ruin and operational breakdowns. These case studies underscore the importance of diligent planning and regular revision of asset protection strategies to ensure they remain aligned with evolving business landscapes and regulatory requirements.

Legal Considerations in Asset Protection

The legal frameworks governing business operations and asset protection are complex, necessitating a proactive approach to stay compliant. Every jurisdiction has its own set of rules that businesses must adhere to, often mandating specific structures or financial arrangements. Maintaining compliance with these legal requirements is essential to avoid ramifications such as fines or asset seizure, which can cripple a business’s operations. Legal professionals are indispensable in this capacity, offering guidance tailored to a business’s unique challenges and opportunities. It’s vital for businesses to keep themselves informed about legislative changes and to consult with legal advisors who can interpret and apply these changes effectively to preserve the business’s integrity and assets.

Common Mistakes to Avoid in Asset Protection

The path to solid asset protection is fraught with pitfalls that can jeopardize a business’s financial footing. Common errors include failing to separate personal and business finances, neglecting insurance coverage, and inadequately documenting business operations. Furthermore, many businesses fall into the trap of designing asset protection mechanisms only at the inception stage and then neglecting them, leading to outdated or ineffective strategies in the face of new challenges. To avoid oversights, businesses should regularly review and update their asset protection strategies, ensuring they are comprehensive and adapt to the changing business environment. Engaging with financial and legal experts can also provide a fresh perspective, potentially revealing vulnerabilities that may have been previously overlooked.

Future Trends and Innovations in Asset Protection

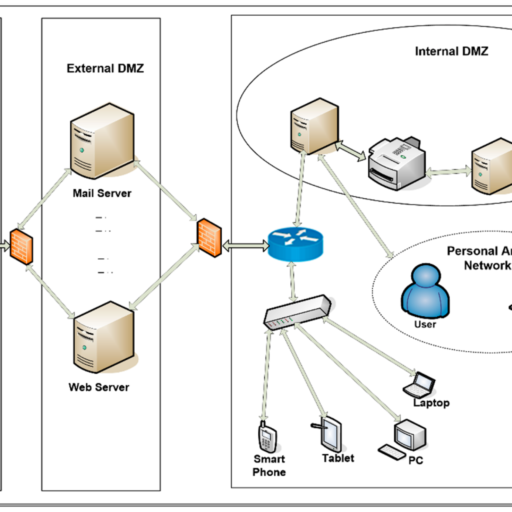

The domain of asset protection is rapidly evolving, influenced by technological advancements and the increasing digitalization of business operations. Key areas of innovation include automated compliance systems, which reduce human error and ensure up-to-date adherence to regulatory requirements. Additionally, blockchain technology offers promising applications in ensuring transparency and security in asset transactions, a critical factor as businesses go digital. As enterprises manage an expansive range of digital assets, including intellectual property and data, understanding and implementing measures to protect these intangible assets is essential. These trends indicate a shift toward more dynamic and expansive asset protection strategies encompassing traditional and emerging business asset forms.

Asset protection is an indispensable component of a resilient business strategy, crucial for safeguarding against potential risks in a highly dynamic economic landscape. Businesses can ensure their longevity and financial health by understanding and leveraging the strengths of different business structures, remaining vigilant against common pitfalls, and complying with legal standards. As future challenges arise, it is paramount to continually reassess and innovate protection strategies, embracing new technologies and methodologies to safeguard against evolving risks. This vigilant approach enables businesses to protect their existing assets and thrive and expand in confidence, knowing they are well-prepared for whatever challenges the future may hold.